Release date:2021-11-23

Looking forward to 2022, we believe that as the adverse impact of the new crown epidemic on the global economy gradually weakens and new production capacity is gradually released, the tight supply of the semiconductor industry chain may be partially alleviated. In the medium and long term, the growth momentum of semiconductor demand is shifting from consumer electronics represented by mobile phones to AIoT, electric vehicles, 5G communications, new energy, industry and other fields. A new round of chip design innovation cycle and domestic substitution cycle is expected to start. With the vigorous development of the domestic chip design industry and the accelerated expansion of wafer manufacturing capacity, we see that domestic companies are currently making rapid breakthroughs in upstream areas such as equipment, materials, and EDA tools (including IP). In addition, we expect that in 2022, a number of semiconductor companies will land in the capital market, bringing more investment opportunities. This article analyzes industry investment opportunities around the three major industrial chain links.

Semiconductor industry review in 2021

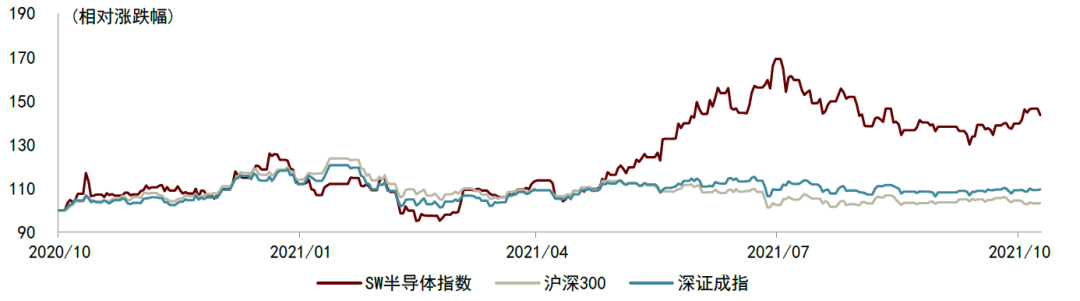

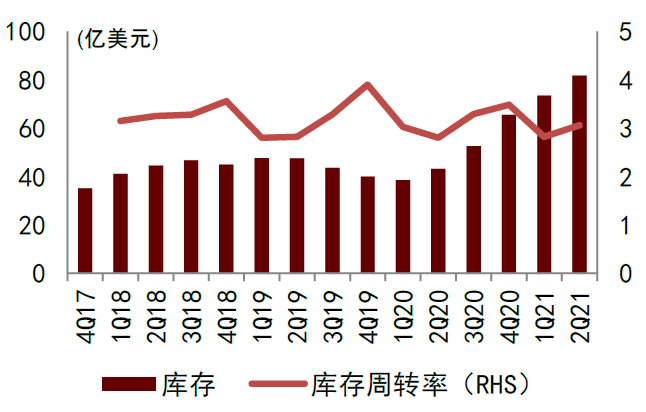

Since the end of 2020, multiple factors such as epidemics and natural disasters have been intertwined, affecting the global semiconductor supply chain, leading to a shortage of chips, and industries such as mobile phones, automobiles, and security have been greatly affected. The increase in the sales price of chips caused by the shortage of stocks has enabled chip design companies to obtain rapid profit growth; on the manufacturing side, fabs, packaging and testing plants have basically achieved full production, and ROE has been increased; at the same time, with the increase in localization rate, domestic equipment The profits of materials companies have been released, and all links in the 1-3Q21 industrial chain have maintained a relatively high rate of revenue and profit growth. Affected by the above factors, the semiconductor index (Shenwan Industry Classification) significantly outperformed the market from April to July 2021. However, from August to October, the overall sector experienced a phased correction, and the stock price performance between the sub-sectors and within the sector diverged. We believe that the main reason is that multiple indicators have caused the market to diverge in the judgment of the prosperity of various fields of the semiconductor industry in 2022. First, the downstream market demand is structurally differentiated. The demand for automotive electronics and new energy power generation (photovoltaic, wind power and energy storage) related chips is strong, and the demand for consumption and communication related chips is weakening. Secondly, the market expects some new wafers worldwide. Manufacturing and packaging and testing capacity will be opened in 2022, so the market is worried about adversely affecting the relationship between supply and demand.

Chart: SW Semiconductor Index's rise and fall in the past year

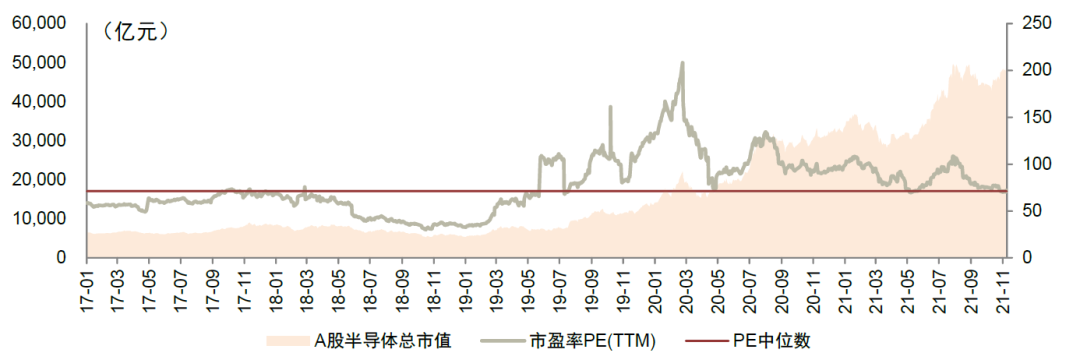

The proportion of semiconductor sector fund holdings declined slightly in 3Q21 and is still at a historical high. Since 4Q18, the proportion of semiconductor holdings and the overweight range have both increased significantly. As of 3Q21, the proportion of A-share full fund semiconductor holdings was 4.97%, a decrease of 0.38ppts from the previous month, and the overweight margin was 1.77%, which was higher than the historical average of 1% overweight.

Semiconductor industry outlook for 2022

Semiconductor design: a new round of innovation and domestic substitution cycle begins

Power semiconductors: Continue to benefit from the demand for new energy power generation/power consumption. The markets for new energy vehicles, photovoltaics & wind power generation, and smart grids continue to grow rapidly, and the short-term imbalance in supply and demand of power devices has prompted downstream customers to transfer orders to domestic manufacturers. In terms of breakdown, domestic power diodes have achieved a certain market share, and IGBTs and high-end MOSFETs have been shipped in batches. We estimate that the extension of domestic power devices to high-end products in 2022 is expected to bring further increase in revenue scale and profitability. Among the third-generation semiconductors, silicon carbide (SiC) devices meet the high-voltage/high-frequency/high-temperature requirements of power electronics. In addition to the device itself, there is a large room for growth in the fields of substrate and epitaxial materials, wafer manufacturing and packaging and testing, and equipment. We It is expected that in 2022, a number of domestic projects will land and achieve mass production, and the application of silicon carbide will accelerate.

Analog chip: a hundred flowers bloom, through the cycle. The wave of development of the domestic analog chip industry has arrived, and Chinese manufacturers are facing rapid development opportunities: 1) China is the largest market for analog chips in the world, but its self-sufficiency rate is low. With the improvement of domestic manufacturers' design and process capabilities and the improvement of supply and demand, superimposed supply Chain security considers accelerating domestic substitution. We believe that domestic manufacturers will usher in greater development opportunities in 2022; 2) Demands such as the improvement of the level of automotive electrification and intelligence, the promotion of Industry 4.0 and the update and iteration of 5G communication technology are expected to drive analog chips (signal chain And power management products, etc.) downstream applications continue to be booming, further opening up the growth space for domestic manufacturers.

CIS chip: The main track of mobile phone innovation, the new demand for automobiles. 1) Multi-camera promotes the increase in CIS shipments, the penetration rate of three-camera continues to increase, and the number of single-camera lenses keeps increasing. 2) High-pixel and small-pixel products are the mainstream trend of Android rear main camera in the next 2-3 years. With the development of ADAS and driverless demand, we expect the compound growth rate of automotive CIS in the next five years to be 20%, with an average unit price of nearly $5. We are optimistic that the increase in the proportion of automotive business in 2022 will drive the profits of CIS manufacturers.

FPGA chip: In line with the new scenarios of downstream applications, domestic FPGAs are promising. After the large-scale construction of my country's 5G network was launched, new 5G applications such as AIoT and industrial control were born, which stimulated the demand for FPGA applications. We believe that the enhancement of the competitiveness of domestic FPGA manufacturers is expected to accelerate the development of the industry.

RF chip: The domestic leader has risen, and the replacement space is vast. Domestic products have achieved technological substitution in discrete devices such as LNAs, switches, and 4G PA modules and occupy a stable share of the Android market. However, they are still in the early stages of development in the more technically difficult 5G PA, filters, and RF front-end modules. We estimate that the current localization rate of radio frequency is less than 10%. The core of the growth of local RF manufacturers lies in the technological breakthroughs and mass production progress of new products, and short-term performance may be affected by fluctuations in mobile phone market demand. We believe that manufacturers with outstanding advantages in RF chip technology, production capacity and management are expected to become industry leaders.

Semiconductor manufacturing: continuous expansion of production capacity, high volume of advanced packaging

Wafer manufacturing: The mismatch between supply and demand will drive the continuous expansion of the mainland's wafer manufacturing industry. Mainland China is the world’s largest chip consumer market. According to IC Insights, the chip market in China will be 144.3 billion US dollars in 2020, accounting for approximately 36% of the world’s total. However, the wafer manufacturing output value is only US$22.7 billion, accounting for approximately 16% of the world’s total. , Supply and demand do not match. In order to narrow the capacity gap, we believe that mainland foundry/memory manufacturers are expected to maintain relatively rapid capacity expansion plans in the next few years. We predict that the Chinese mainland wafer manufacturing market is expected to maintain a CAGR of more than 15% by 2025. The annual market size is expected to reach 48 billion US dollars.

Packaging and testing: 5G, AIoT, automotive electronics and other downstream demand are accelerating. Yole predicts that the global advanced packaging market is expected to increase from 30 billion U.S. dollars in 2020 to 47.5 billion U.S. dollars in 2026. We believe that the entire industry chain is expected to benefit from this round of technological innovation. .

Semiconductor equipment materials and EDA: the share of domestic manufacturers continues to increase

Front-end manufacturing equipment: With the growth of capital expenditures in the domestic wafer manufacturing industry, we estimate that China's semiconductor equipment market is expected to reach 32 billion US dollars in 2025, and the CAGR will reach 11.32% in 2021-2025. At present, domestic semiconductor equipment manufacturers can meet mature process technology and some advanced process requirements in many sub-equipment fields such as thin film deposition, etching, cleaning, and de-glue, and achieve large quantities of shipments.

Semiconductor materials: Benefiting from the expansion cycle of the domestic wafer manufacturing industry, we believe that China's semiconductor materials market is expected to exceed US$15 billion in 2025, and the CAGR is expected to remain above 10% from 2021 to 2025. Semiconductor materials have also made great progress. We see that companies with strong competitiveness have emerged in key material fields such as silicon wafers, CMP materials, photoresists, electronic special gases, wet electronic chemicals, and target materials.

EDA: Many companies are expected to land in the capital market, and China's EDA industry has ushered in a period of development opportunities. In recent years, the number of integrated circuit design companies in my country has grown substantially, providing a fertile soil for the growth of China's EDA industry. We believe that the size of China's EDA market is expected to reach RMB 8 billion in 2025, with a CAGR of 12.21% from 2021 to 2025. A number of excellent EDA manufacturers have emerged in China, and they have achieved breakthroughs in part of the whole process and point tools. The global digital transformation is bringing about a new round of demand for computing power. The cost of chip design in the post-Moore era has generally increased substantially, which has caused system manufacturers to continuously increase the demand for chip customization. In the future, the development path of openness and standardization, automation and intelligence, platformization and service will also achieve broad prospects for China's EDA industry.

Global semiconductor industry prosperity index

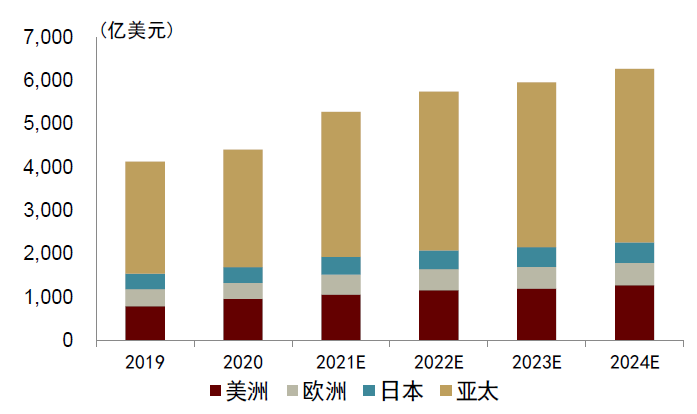

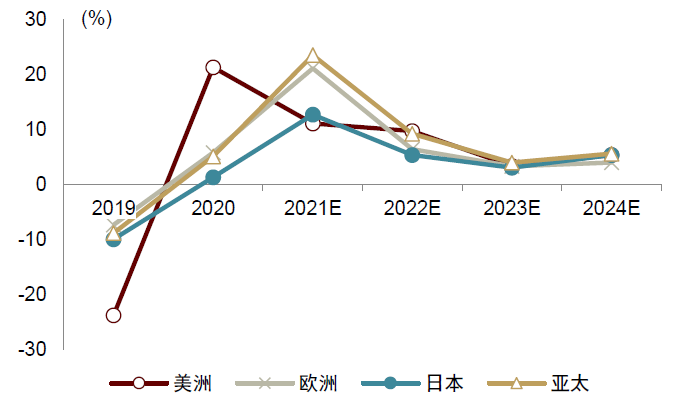

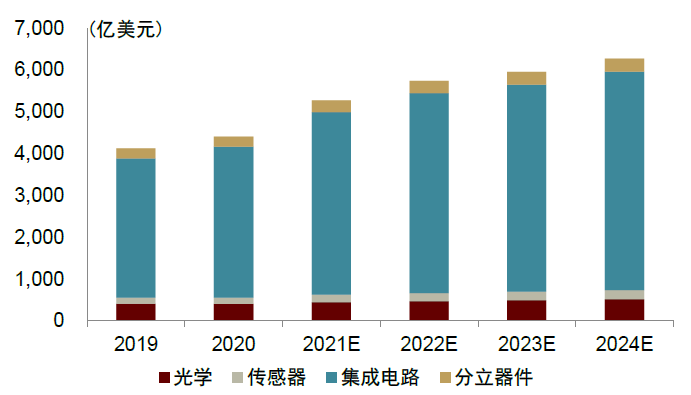

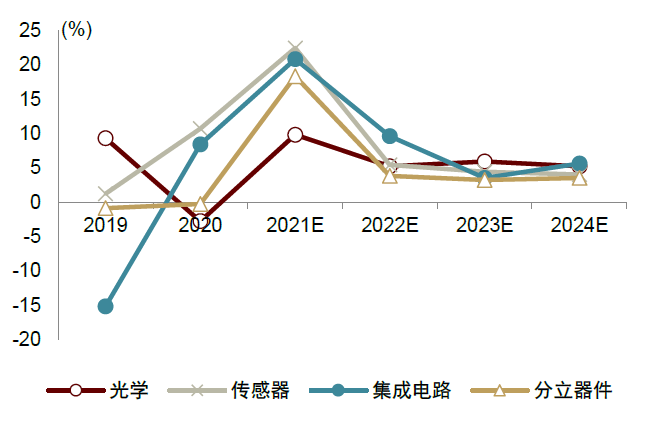

The global semiconductor market is expected to reach US$527.2 billion in 2021. WSTS predicts that the total global semiconductor output value from 2021-2024 will reach 5,272/5,734/5,949/6271 billion US dollars, with a year-on-year growth rate of 19.7%/8.8%/3.7%/5.4%, and a CAGR of 9.2% in 2020-2024. In terms of regional distribution, WSTS predicts that the total output value of semiconductors in the Americas/Europe/Japan/Asia Pacific regions by 2024 will be 1,269/519/471/4,0113 billion US dollars. In terms of application scenarios, WSTS estimates that the market segments of optical/sensor/integrated circuit/discrete devices will be 520/210/5,229/312 billion US dollars by 2024.

Chart: Total global semiconductor production value (by region)

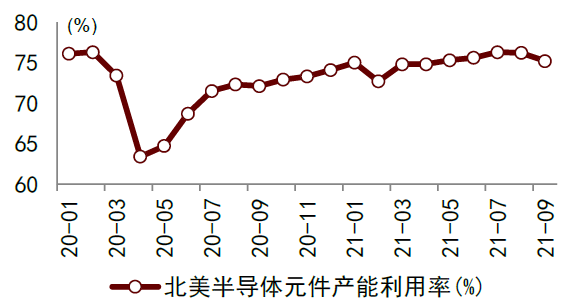

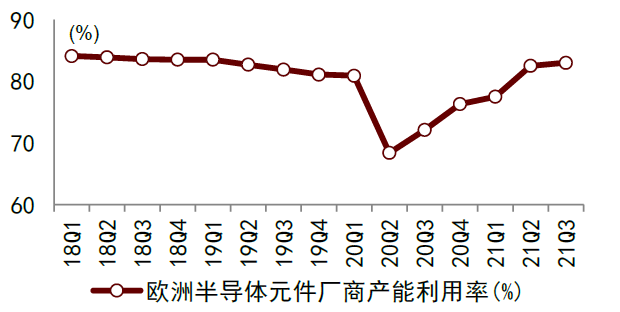

The capacity utilization rate of semiconductor component manufacturers has basically returned to the level before the epidemic. Since 2Q21, although repeated epidemics have caused capacity utilization to fluctuate, semiconductor component manufacturers have resumed work and production steadily, and overall capacity utilization has been on the rise.

Chart: Capacity utilization rate of major semiconductor component suppliers in North America

Globally, the willingness of wafer manufacturing plants to expand production is obvious, and the shipment value of equipment manufacturers is still in a fast-rising channel. Wind data shows that since 2021, the monthly shipment value of North American & Japanese semiconductor equipment manufacturers has increased significantly. Among them, the shipment of North American semiconductor equipment vendors reached a peak in July this year, at about 3.9 billion U.S. dollars; the shipment of Japanese semiconductor equipment vendors reached a peak in May of this year, at about 305.4 billion yen (about 2.7 billion U.S. dollars). Since then, shipments have declined slightly, and there has been a rebound trend since September. Domestic semiconductor equipment manufacturers are gradually participating in global competition while gradually satisfying the domestic demand for new equipment.

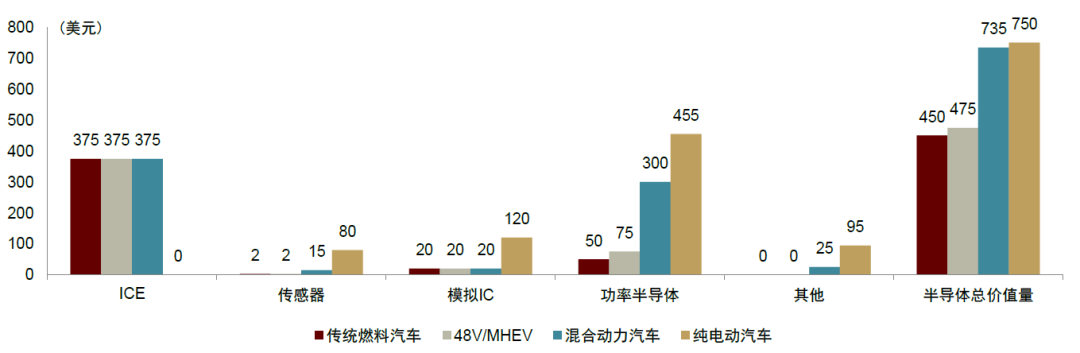

The trend of "Electrification + Intelligence" drives the expansion of the automotive semiconductor market. (1) Automotive chips: Under the trend of intelligence, technologies such as smart cockpits and smart driving put forward higher technical requirements for automotive hardware architecture and computing power. Therefore, the field of automotive chips shows a shift from traditional MCU chips to more powerful performance. The development trend of SoC chips. (2) In terms of power devices: mainly including IGBT, SiC, etc., the value of a single vehicle in a pure electric vehicle can reach US$455. With the in-depth development of the electrification trend, the demand for power devices will increase by orders of magnitude. (3) In terms of sensors: Radar and cameras are the main products. In pure electric vehicles, the value of a single vehicle can reach US$80, which is 40 times that of traditional fuel vehicles.

Chart: Comparison of the estimated value of different automotive semiconductors (2020)

Semiconductor design: a new round of innovation and domestic substitution cycle begins

Power devices: continue to benefit from the demand for new energy/power generation

Overview of the power device industry: domestic manufacturers are gradually replacing high-end IGBT devices, and each link of the SiC (silicon carbide) industry chain has a layout. The domestic power device industry chain itself already has certain competitive strength, and there is a lot to do in the future. In terms of breakdown, domestic power diodes have achieved a certain market share. In addition, in the third-generation semiconductors, silicon carbide (SiC) devices meet the high-voltage, high-frequency and high-temperature requirements of power electronics. In addition to the devices themselves, there is a large room for growth in the fields of substrate and epitaxial materials, wafer manufacturing and packaging and testing, and equipment.

Silicon Carbide Devices and Materials: Industry Landing Welcomes Opportunities

Overview of the silicon carbide industry: Devices made of wide band gap material silicon carbide (SiC) have excellent switching performance, voltage resistance and temperature stability. The current industry development pain point lies in the high preparation cost and low yield of substrate materials The high price brought. We expect that with the maturity of technology and the expansion of supplier capacity, the cost of SiC is expected to achieve a rapid decline. In the next five years, SiC will be used in multiple application scenarios such as electronic control, on-board chargers, DC/DC, and fast charging piles. / Si-IGBT forms a scale replacement.

Analog chip industry review in 2021: On the industry side, monthly shipments and sales of global analog chips will fluctuate upward in 2021. Consumer electronics, automotive electronics, and pan-industrial sectors will be the main driving forces of the domestic market. On the production side, according to WSTS, the global monthly shipment of analog chips in 2021 will fluctuate from 12.6 billion units in January to 17.1 billion units in September. On the price side, as a whole, the global average price of analog chips in 2021 will be steady and declining. On the market scale, global analog chip sales rose from US$4.19 billion in January to US$5.18 billion in September. On the downstream application side, consumer electronics, automotive electronics, and pan-industrial fields are the main driving forces of the domestic market.

The 2022 outlook of the analog chip industry: optimistic about the ability of domestic analog chip companies to traverse the cycle. According to the China Semiconductor Industry Association, China's analog chip self-sufficiency rate in 2020 is only about 12%. We use the CAGR of my country's analog chip market scale in 2021-2025 to be 9.6%, and the analog chip self-sufficiency rate in 2025 as a neutral condition for the scenario. According to analysis, it is estimated that in 2025, my country's domestic analog chip replacement space will be about 49.5 billion yuan under neutral conditions. Compared with the scale of revenue of listed companies in the domestic analog chip industry, there is still a large potential increase in performance under domestic substitution logic.

At present, domestically-made FPGA products are mainly low- and medium-density products, and there is a lot of room for development. Beginning in the 1990s, domestically-made FPGAs have gone through a period from reverse design to forward design. In 2017, domestically-made FPGAs officially entered the stage of complete forward design. Domestic FPGA products currently active in the market are mainly low- and medium-density products, and most of the architecture adopts the concept of LUT+ wiring. Compared with international leaders, the technical level of medium and high-density FPGAs still has a large gap in hardware design and software.

Source: CICC Research